CHASING THE WIND: COUNTING ON CRYPTO TO CRUSH THE RACIAL WEALTH DIVIDE

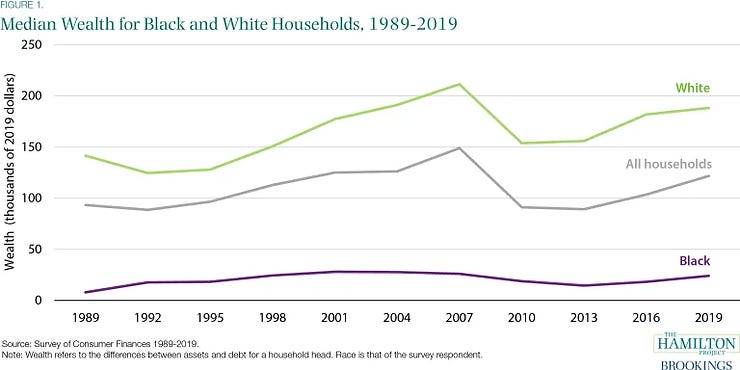

The racial wealth gap is both staggering and persistent. As illustrated in the graph below, the median wealth of White and Black households is $188,200 and $24,100. In other words, half of White families have a net worth of above $188,200 , while the other half possess a level of wealth that's less than that. The cutoff point for Black households is obviously much lower: 50% of Black households have a net worth that exceeds $24,000, while the other half's wealth level is less than $24,000. Thus, median White household is currently rocking a wealth level that's almost eight times that of the median Black household ($188,200/$24,100).

By the way, researchers have also used mean wealth figures to compare the net worth of Black and White households. Whereas the median is the figure that's right in the middle of the distribution, the mean is simply derived by totaling the collective wealth of a group and then dividing the resulting figure by the number of households in that group. It's an average, and the most recent data on wealth indicates that the average White and Black households hold $983,400 and $142,000, respectively. In other words, the average White household's level of wealth is 7 times that of the average Black household ($983,400/$142,500).

Any way you cut it, though, the net worth of Black households is completely dwarfed by that of their White counterparts. You're comparing pennies to dollars, with Black households having anywhere from 13-15 cents for every dollar of wealth held by White households.

DUAL NARRATIVES: THE CASE FOR CRYPTO

Over the last several years a growing number of voices have been vigorously promoting the cryptocurrency as the key to drastically improving the relative financial status of Black folk. The voices have given rise to two narratives about the allegedly financially empowering potential of cryptocurrency. One narrative tends to focus on what is deemed to be the power and potential of crypto to do what the traditional financial and banking system has failed to do -- that is, to provide unbanked and underbanked communities with unimpeded access to financial services. The other narrative--and the one directly related to this post-- is grounded in the idea that crypto ought to be embraced as a route toward via which Black folk can build up wealth and, ultimately, eliminate the racial wealth divide.

This latter narrative, then, exhorts Black folk to view crypto not primarily as a medium of exchange-- not as money-- but more so as a valuable asset that'll, if held long enough, will increase in value. Crypto, according to this view, is something you can make bank on and thereby increase your wealth. Indeed, according to a recent survey, this is how most crypto owners view cryptocurrency-- more as a way of making money and increasing wealth than as "stuff" you can use to make payments.

A major problem, though, is that crypto's volatility and highly speculative nature makes it an extremely unlikely route toward the diminishment of the racial wealth gap. Crypto's price can be all over the board, with astronomically high prices sometimes being followed by mind-blowing decreases. When the price of an asset can jump around like crazy, it's very unlikely to have the capacity of functioning as a stable foundation for building group wealth and, in our case, for stomping the racial wealth gap out of existence.

What's more-- and as a number of others have noted-- cryptocurrencies are devoid of any intrinsic value. Their value is completely derived from what other people think the future value will be. They have value just as long as people believe that they have value. They're not backed by anything and, so, there's no "there" there. But that's the nature of speculative assets, and the value is largely based on the "greater fool theory."

Here's how one scholar captures this:

Despite the vast amount of money poured into crypto and related products over the years, crypto has not developed past the use case as a speculative asset. Thus, the narrative of using crypto for wealth-building for Black and Latino or Hispanic communities assumes that it can serve as an appreciative asset that can generate wealth. Here too, cryptocurrencies are a vulnerable option, because they have no intrinsic value and are not backed by anything; they are simply grounded in speculation. Cryptocurrencies derive their value from other people believing they are good investments, but if that changes, the value can quickly drop to nothing, which can be particularly risky for populations that do not have existing or inherited wealth to fall back on.

Don't get me wrong. I'm not claiming that it's impossible to make money in crypto. I know that, with a combination of money and luck that you can hit a lick at the casino. I know that, when it comes to a speculative asset, you can make bank if you get "in" and "out" at the right time.

I'm just highly skeptical of the ability of any group to speculate it's way to greater wealth. I'm just highly skeptical of the capacity of anything that's intrinsically worthless to wither away a wealth differential that's grounded in a history of racial and class domination. I'm just skeptical of any response to the racial wealth divide that essentially boils down to telling Black folk, "Take what scratch you got and hit the casino."

No doubt there has been--and will continue to be-- people who make money from owning and trading cryptocurrencies. There's also little doubt that there'll will be some big time losers-- and, monetarily speaking, that the losses will exceed the gains.

But counting on crypto to eradicate the racial wealth divide is nothing more than chasing the wind.